Navigating the world of Crypto taxes

Cryptocurrencies have surged in popularity, transforming from niche digital assets to mainstream financial instruments. As their use grows, so does the complexity of their tax implications. This guide is here to provide you with the professional guidance and expertise you need to navigate the world of Crypto taxes, ensuring compliance and effective financial planning.

This guide aims to demystify Crypto tax regulations across various regions, providing a comprehensive overview for investors and traders. Understanding the tax landscape allows you to confidently navigate your Crypto investments and avoid potential pitfalls.

Here’s how to report crypto on taxes a few jurisdictions around the world.

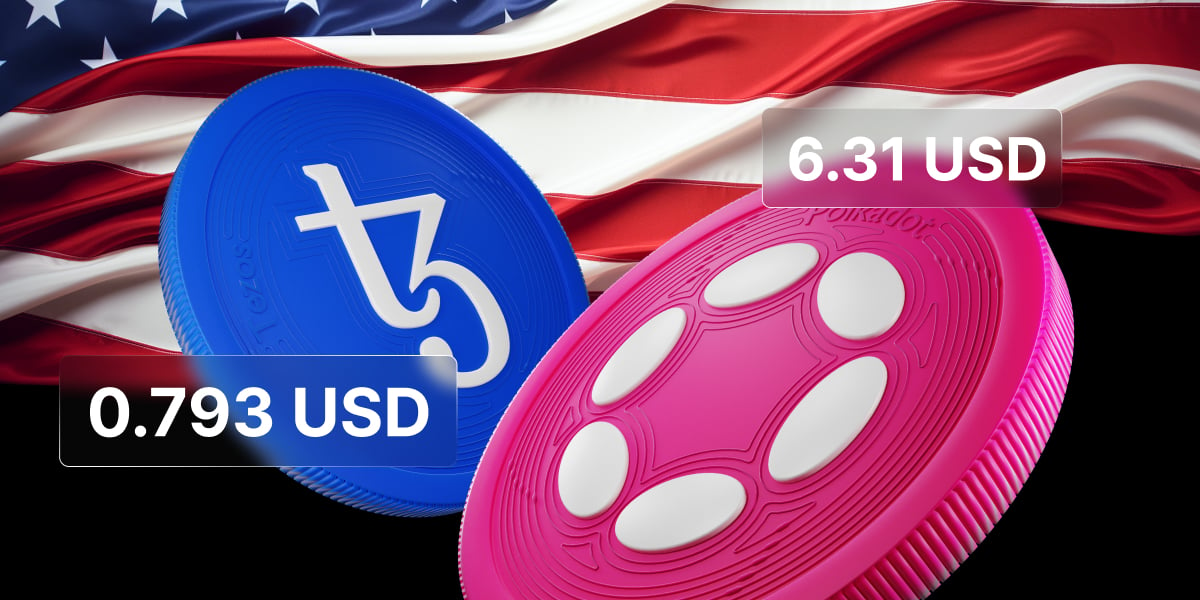

United States: Reporting Crypto to the Internal Revenue Service (IRS)

Key regulations

The IRS treats Cryptos as property, which means they are subject to capital gain or loss, similar to stocks or real estate. This classification mandates that investors report Crypto transactions, including buying, selling, and exchanging digital assets. Additionally, income from digital assets, such as mining or staking, is taxable and must be reported as ordinary income. Understanding these distinctions is crucial for accurate tax reporting and compliance.

Taxable events and reporting

Taxable transactions include buying, selling, and transferring digital assets. Each transaction must be reported on Form 8949, detailing its fair market value and cost basis. These figures are then summarized on Schedule D. The IRS requires precise documentation of each transaction’s value at the time of the event. Cryptocurrency brokers and exchanges must issue a 1099 form to their clients for the current tax year, which helps track these transactions.

The IRS’s classification of Cryptocurrencies as property has significant implications for tax reporting. Any Crypto transaction, whether a sale, exchange or even a gift, can trigger a taxable event. For instance, if you purchase a Cryptocurrency and later use it to buy goods or services, you must report any capital gain or loss based on the difference between the purchase price and the value at the time of the transaction.

This is similar to reporting capital gain or loss from selling stocks. Moreover, income generated from activities like mining or staking is considered ordinary and must be reported. This includes the Cryptocurrency’s fair market value when it was received. The IRS has been increasing its enforcement efforts, including hiring private-sector Crypto experts and requiring exchanges to share customer data.

To ensure compliance, it’s essential to keep meticulous records of all Cryptocurrency transactions. This includes logging the amount spent, the market value at the time of the transaction, and any associated fees. For each taxable event, you must report the details on Form 8949, which tracks capital gains and losses.

These details are then summarised on Schedule D of your tax return. The IRS has made it clear that there is no room for taxpayers to claim ignorance regarding the reporting of Crypto transactions. Whether a taxpayer has dealt with digital assets is prominently featured on Form 1040. If you check “Yes,” the IRS will look for Form 8949 to ensure all taxable events have been reported. Failure to report these transactions can result in penalties for underreported taxes.

Additionally, the IRS has introduced new measures to close loopholes and increase compliance. For example, the proposed fiscal year 2025 budget includes a Crypto mining excise tax and measures to close the Crypto wash sale loophole. These changes highlight the importance of staying informed about the latest regulations and accurately reporting all Crypto-related activities.

Common questions

Do I need to report my Crypto on taxes?

Yes, all Crypto transactions must be reported, regardless of the amount.

How much tax will I pay on Crypto gains?

The tax rate depends on your overall income and the asset’s holding period. Long-term gains (over a year) are taxed at 0%, 15%, or 20%, while short-term gains are taxed as ordinary income.

United Kingdom: HMRC and Crypto taxation

Understanding capital gains tax

HMRC treats Cryptocurrencies as assets subject to capital gains taxes in the UK. Investors must report gains and losses from Crypto transactions, with gains taxed at 10% or 20%, depending on the individual’s income tax bracket. Losses can be used to offset capital gains, reducing the overall tax liability.

Specifics of Crypto transactions

Transferring digital assets can trigger tax liabilities, especially if the transfer involves a change in ownership. Keeping detailed records of each transaction, including dates, values, and purposes, is crucial for accurate reporting. HMRC requires these records to be maintained for at least six years.

Reporting requirements and allowances

In the UK, the annual tax-free allowance for capital gains is £12,300 for individuals (as of the 2023/24 tax year). Any gains above this threshold are subject to capital gains tax. Utilising this allowance effectively to minimise tax liabilities is essential. For instance, strategic selling of assets to stay within the allowance can be beneficial.

Crypto income and miscellaneous taxes

Apart from capital gains, any income earned from Crypto activities, such as mining, staking, or receiving Crypto as payment, is subject to income tax. This income must be reported on the self-assessment tax return. The tax rate will depend on the individual’s overall income, potentially reaching up to 45% for higher earners.

Record-keeping best practices

Consider using specialised software or services that track and report Crypto transactions to ensure compliance and ease the tax filing process. These tools automatically log transactions, calculate gains and losses, and generate necessary tax forms. This approach not only saves time but also reduces the risk of errors.

International considerations

For UK residents with Crypto holdings or transactions in other countries, it’s crucial to understand the tax implications in those jurisdictions. Double taxation treaties may provide relief, but reporting foreign income and gains accurately to HMRC is essential. Failure to do so can result in penalties and interest on unpaid taxes.

FAQs

How are you taxed on Crypto in the UK?

Crypto gains are taxed as capital gains, with rates depending on your income bracket.

Do I need to report Crypto gains under a certain threshold?

Yes, all gains must be reported, but you only pay tax if your total gains exceed the annual tax-free allowance.

Canada: Crypto taxes and the CRA

Taxable events and capital gains

In Canada, the Canada Revenue Agency (CRA) classifies Cryptocurrencies as commodities. This classification means that any transaction involving Crypto can trigger a taxable event. Taxable events include buying, selling, and exchanging Cryptocurrencies.

When you dispose of your Crypto, you must report any capital gains or losses on your tax return. The CRA taxes capital gains at 50% of the individual’s marginal tax rate, meaning only half of the gain is subject to tax. For instance, if you realize a $10,000 gain, only $5,000 will be taxed at your applicable rate.

Reporting and compliance

To report Crypto transactions to the CRA, you must complete Schedule 3 of your tax return. This form requires you to detail each transaction’s fair market value at the time of the event and the cost basis.

Accurate record-keeping is crucial to ensure compliance and avoid penalties. The CRA mandates that you maintain detailed records of all your Crypto transactions, including dates, amounts, and the value in Canadian dollars at the time of each transaction. Additionally, any income earned from Crypto activities such as mining, staking, or receiving payments in Cryptocurrency must be reported as business income.

This income is subject to the same tax rules as other business income, and you must include it in your total income for the year. The CRA has been increasingly vigilant in monitoring Crypto transactions, so staying compliant is essential to avoid audits and penalties.

Common queries

How much tax do I pay on Crypto gains in Canada?

Crypto gains are taxed at 50% of your marginal tax rate.

Are Crypto gains reported to the CRA?

Yes, all Crypto gains must be reported on your tax return.

Australia: ATO guidelines for Crypto investors

Capital gains and losses

The Australian Taxation Office (ATO) treats Cryptocurrencies as property, subjecting them to capital gains tax (CGT). Investors must report all gains and losses from Crypto transactions. Gains are taxed at the individual’s marginal tax rate, which varies based on their total income. Notably, holding Crypto assets for more than a year may qualify for a 50% discount on the capital gains tax, significantly reducing your tax liability.

Tax deductible activities

Tax loss harvesting is a strategic approach that allows investors to offset their capital gains with losses, thereby reducing their overall tax liability. Accurate reporting of capital losses is essential to maximize these benefits. The ATO mandates detailed transaction records, including each transaction’s dates, values, and purposes. This meticulous record-keeping ensures compliance and optimizes tax outcomes.

Additional insights

- Crypto-to-Crypto Transactions: It’s important to note that Crypto-to-Crypto transactions are also considered taxable. Exchanging one Cryptocurrency for another triggers a CGT event, and any gains or losses must be reported.

- Personal use assets: Cryptocurrencies used for personal transactions, such as buying goods or services, may be exempt from CGT if they cost less than AUD 10,000. However, this exemption does not apply if the Cryptocurrency is held as an investment.

- Staking and airdrops: Income from staking and airdrops is considered ordinary income and must be reported. The value of the Cryptocurrency received from these activities should be included in your assessable income when it’s received.

Frequently asked questions

How do I write off Crypto taxes in Australia?

You can offset gains with losses through tax loss harvesting.

Do I pay tax on my Crypto?

Yes, all Crypto transactions must be reported, and gains are subject to capital gains tax.

Latin America: Crypto Tax Landscape

Argentina, Brazil, and Mexico

Crypto tax regulations in Latin America vary significantly. Argentina treats Crypto as property, subjecting it to capital gains tax. Recently, the Argentinian authorities introduced a bill to eliminate Crypto tax opportunities, which is still under consideration.

As things stand, Brazil requires reporting of all Crypto transactions, with gains taxed at progressive rates. For transactions under 5 million reais (approximately $990,000), the tax rate starts at 15%. For transactions exceeding 30 million reais (around $6 million), the tax rate rises to 22.5%, with varying rates for intermediate amounts.

Mexico has no clear guidelines, but Crypto is generally treated as property.

Tax benefits and implications

Holding digital assets can offer tax benefits, such as deferring capital gain until the capital asset is sold. Understanding the specific taxable events and how they are treated in each country is crucial for compliance and optimisation.

Key questions

How much tax will I pay on Crypto in Latin America?

Tax rates vary by country, with Argentina and Brazil imposing capital gains tax and Mexico’s regulations still evolving.

Are there any tax-free thresholds for Crypto gains?

Each country has different thresholds and exemptions, so it’s essential to consult local regulations.

Spain: Reporting Crypto to the Agencia Tributaria

Taxable income and gains

In Spain, Cryptocurrencies are subject to capital gains tax. Investors must report gains and losses from Crypto transactions to Agencia Tributaria, and gains are taxed from 19% to 23%. Accurate reporting of each transaction’s fair market value and cost basis is essential for compliance.

Compliance and reporting

Reporting Crypto transactions to the Agencia Tributaria involves completing Form 720 for foreign assets and detailing each transaction’s value. Maintaining detailed records of all transactions is crucial for accurate reporting and avoiding financial interest and penalties.

Common inquiries

Do you have to report Crypto under €600?

Yes, all gains must be reported, but you only pay tax if your total gains exceed the annual tax-free allowance.

How are Crypto gains taxed in Spain?

Depending on the amount, they are taxed at rates ranging from 19% to 23%.

Turkey: Crypto tax regulations

Capital gains and digital assets

Turkey treats Cryptocurrencies as property, subjecting them to capital gains tax. Investors must report gains and losses from Crypto transactions, with gains taxed at progressive rates. Understanding the specific regulations and reporting requirements is crucial for compliance.

Reporting and compliance

Reporting Crypto transactions in Turkey involves detailing each transaction’s fair market value and cost basis. Accurate records are essential to ensure compliance and avoid penalties. The Turkish tax authority requires detailed documentation of all transactions.

Frequently asked questions

Do I need to report my Crypto on taxes in Turkey?

Yes, all Crypto transactions must be reported.

What are the tax implications of Crypto gains?

Crypto gains are subject to capital gains tax at progressive rates.

Thailand: Crypto taxation framework

Taxable events and reporting

In Thailand, Cryptocurrencies are subject to capital gains tax. Taxable events include buying, selling, and exchanging Crypto. Investors must report these transactions on their tax returns, detailing each transaction’s fair market value and cost basis.

Capital Gains and Losses

Crypto gains are taxed at the individual’s marginal tax rate. Accurate reporting of each transaction’s value is essential for compliance. The Thai tax authority requires detailed records of all transactions.

Key queries

How much tax will I pay on Crypto gains in Thailand?

Crypto gains are taxed at the individual’s marginal tax rate.

Are there any specific exemptions for Crypto investors?

Thailand does not currently offer specific exemptions for crypto investors.

Vietnam: Navigating Crypto taxes

Understanding capital gains

Vietnam treats Cryptocurrencies as property, subjecting them to capital gains tax. Investors must report gains and losses from Crypto transactions, with gains taxed at the individual’s marginal tax rate. Understanding the specific regulations and reporting requirements is crucial for compliance.

Compliance and Reporting

Reporting Crypto transactions in Vietnam involves detailing each transaction’s fair market value and cost basis. Accurate record-keeping is essential to ensure compliance and avoid penalties. The Vietnamese tax authority requires detailed documentation of all transactions.

Frequently asked questions

Do I pay tax on my Crypto in Vietnam?

Yes, all Crypto transactions must be reported.

How are Crypto gains reported to the tax authorities?

Crypto gains are reported on the individual’s tax return, detailing each transaction’s value.

Conclusion: Staying compliant with Crypto tax laws

Staying informed about local tax regulations is crucial for Crypto investors. Maintaining accurate records and reporting transactions can help avoid legal issues and optimize tax liabilities. Consulting with tax professionals is highly recommended for complex situations to ensure compliance and take advantage of potential tax benefits.

Additional resources and tools

Here are some of the best tools for tracking and calculating crypto taxes.

How are you taxed on Crypto in the UK?

Crypto gains are taxed as capital gains, with rates depending on your income bracket.

Do I need to report Crypto gains under a certain threshold?

Yes, all gains must be reported, but you only pay tax if your total gains exceed the annual tax-free allowance.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.