Ethereum fell over 2.5% across the past week, dropping to a low of around $3000 after the Securities and Exchange Commission delayed its decision on Invesco’s ETH ETF application before attempting a recovery. ETH /USD trades at $3120 at the time of writing.

In a filing on Monday, the SEC pushed the next deadline out 60 days to July 5, 2024, to approve or disapprove the proposed spot ether ETF. The SEC had previously delayed the decision on Invesco’s ETH ETF in February, and this comes as the agency has pushed back deadlines for other ETF proposals from Grayscale, Franklin Templeton, VaEk, and Blackrock in recent weeks.

ETH ETF optimism fades

Optimism surrounding an ETH ETF has faded considerably in recent months. Bloomberg ETF analyst Eris Balchunas downwardly revised expectations of a spot ETF approval by late May to 25% from 70%. He cited a prolonged period of silence from the SEC to prospective fund issuers, combined with increasing political pushback from SEC Chair Gary Gensler, as reasons for a decreasing likelihood of approval.

Spot market Ethereum ETFs would allow Wall Street firms and investors to gain indirect access to ETH without dealing directly with crypto exchanges or wallets. Ether is the second-biggest crypto asset by market cap, with its $370 billion market capitalization, nearly a third of Bitcoin’s $1.25 trillion market cap. US issuers started trying to launch a spot ETH ETF product as far back as 2021.

Bitcoin ETFs finally got approval on January 11, and many assumed that the spot ETH ETF would be right behind BTC ETFs in being approved. This assumption helped drive ETH/USD to a 2.5-year high of $4090 in early March, as Bitcoin rose to its ATH of $73,750 at the same time.

Hong Kong & US ETFs

The latest development comes after ETH ETFs were approved alongside BTC ETFs in Hong Kong last week, and investors continue to monitor Bitcoin ETF inflows closely.

Putting aside the timeline, the other question relates to demand. Even if the ETH ETF were approved, what would demand look like if and when it debuted?

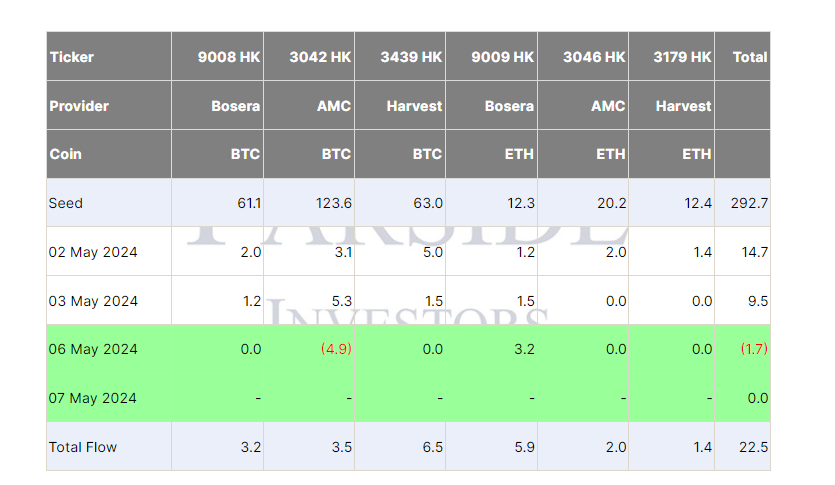

Between the Kong ETFs and US spot bitcoin fund flows, we could start to paint a picture. Hong Kong’s six new crypto ETFs, 3 Bitcoin and 3 Ether funds, opened with $292 million in seed capital, according to Farside Invetors data. The Bitcoin funds attracted more of that initial capital, with the ETH ETF day-one asset amounting to 15% of that. Meanwhile, subsequent flows into the ETFs have been low. This difference is not surprising, given the lesser name recognition than Bitcoin.

Farside Investors Hong Kong ETF flows chart.

US spot Bitcoin ETFs experienced net inflows of $217 million on May 6. This surge comes after massive outflows in recent weeks. With a combined net asset value of $52.2 billion, the 11 approved BTC ETFs now make up 4.19% of the total Bitcoin market value.

Given how quickly the BTC ETF changed the Bitcoin landscape, it’s clear how an ETH ETF could do something similar for Ether. However, the likelihood of this happening soon appears unlikely for now.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.