Bitcoin jumped to above $66,000 on Wednesday and held above that level today amid expectations that the Federal Reserve could start to cut interest rates this year. Data shows that Bitcoin rose to 7.5% to 66,250, its largest one-day rise since March 20.

Other major coins have also enjoyed strong gains, with Ethereum rising 5% to reach the 3000 psychological level, and the overall crypto market rate swelled by 5%, reaching $2.4 trillion in valuation.

The jump came after data from the US Labour Department yesterday showed that inflation, as measured by the Consumer Price Index (CPI), rose less than expected in April. The CPI rose 0.3% month on month after rising 0.4% in March, which was below forecasts of 0.4%. Meanwhile, on an annual basis, inflation cooled to 3.4%, marking the first cooling in inflation in six months.

Other data also showed that retail sales growth stalled in April at just 0%. This was below the 0.4% expected and down from 0.7% in March. Weaker retail sales point to a weaker consumer and raise the likelihood of lower inflation in the coming months.

Fed rate cut expectations

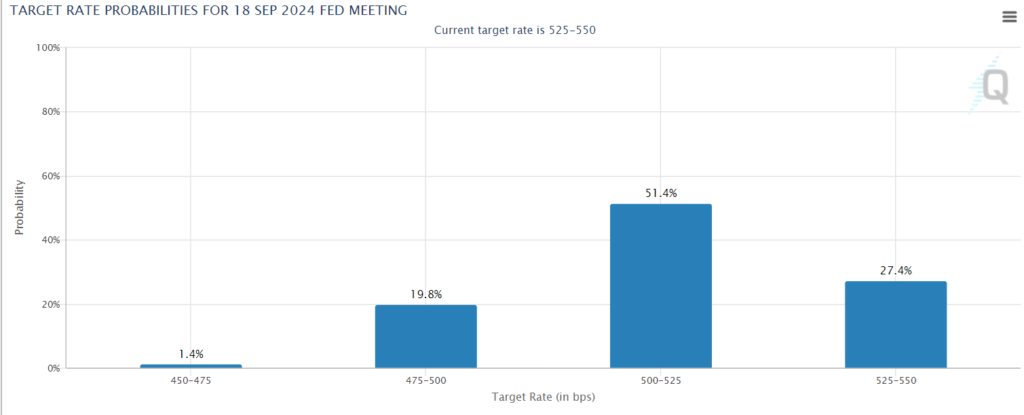

The inflation and retail sales data have raised Federal Reserve rate cut expectations. According to the CME Fed Watch tool, the market expects the Fed to deliver its first 25 basis point rate cut in September and is expected to cut interest rates twice before the end of the year.

However, the Fed is not the only one expected to cut rates. The European Central Bank (ECB) has also signaled that it will cut rates in June, and the Bank of England is preparing to cut rates in the coming months. The first-rate cut is expected in August or September.

Central banks moving towards looser monetary policy have improved liquid AT, which is positive for risk assets such as cryptocurrencies and equities. Of note, the US S&P 500 and the NASDAQ rose to fresh all-time highs on Wednesday.

Significant BTC ETF investment

Not only is the macroeconomic backdrop more supportive of Bitcoin, but figures surrounding Bitcoin ETFs are also looking bullish.

Over the past week, over 600 firms have revealed significant investments in spot Bitcoin ETFs amid the latest 13F filings for the U.S. Securities and Exchange Commission. As per the filing date, May 9, 563 professional investment firms reported owning 3.5 billion worth of Bitcoin ETFs. These included big names such as Morgan Stanley, JP Morgan, Wells Fargo, UPS, and Royal Bank of Canada, as well as hedge funds such as Millennium Management.

The spot Bitcoin ETF was approved on January 11th and has seen massive demand throughout the first quarter. However, inflows have slowed significantly over the past month. Even the 13 F filings show that hundreds of financial institutions have revealed billions in investments in the BTC ETF.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.