- Bitcoin smashes through 71k as EFT flows soar

- Fed rate cut expectations rise after weak data

- BNB rises to an ATH after lagging peers in 2024

Bitcoin has risen 2.9% over the last 24 hours, reaching a peak of $71,166 and marking a three-week high.

A combination of factors is boosting the price, including ETF inflows and rising expectations that the Federal Reserve will cut interest rates soon.

Spot Bitcoin ETFs posted a 16th straight day of net inflows, with $886.6 million, the largest daily inflow since Bitcoin ETF approval in January.

Fidelity led the charge with $378.7 million in inflows, a new record high for the fund. BlackRock also saw strong inflows of $274.4 million. An ongoing interest in BlackRock’s iShare Bitcoin ETF has made it the fastest ETF to reach $20 billion in assets, highlighting not only strong momentum but also investor enthusiasm.

Fed rate cut expectations rise

In addition to strong ETF inflows, increased confidence that the Federal Reserve could cut interest rates this year has helped Bitcoin rise 12% in just 30 days. The markets are increasingly pricing in the chances of a Fed rate cut as soon as September after a string of weaker-than-expected U.S. economic data.

On Monday, US ISM manufacturing activity showed a second straight month of contraction, and construction spending also fell sharply in signs that the US economy is slowing. Data also showed a softening in the US jobs market as job openings fell for a second straight month. The US Bureau of Labour Statistics report on job openings showed that there were 8.1 million job openings, with 1.2 available jobs for every job seeker. This was the lowest ratio in 3 years.

The data comes ahead of Friday’s key nonfarm payroll report, which, if weaker than expected, could be the catalyst to send Bitcoin toward fresh all-time highs.

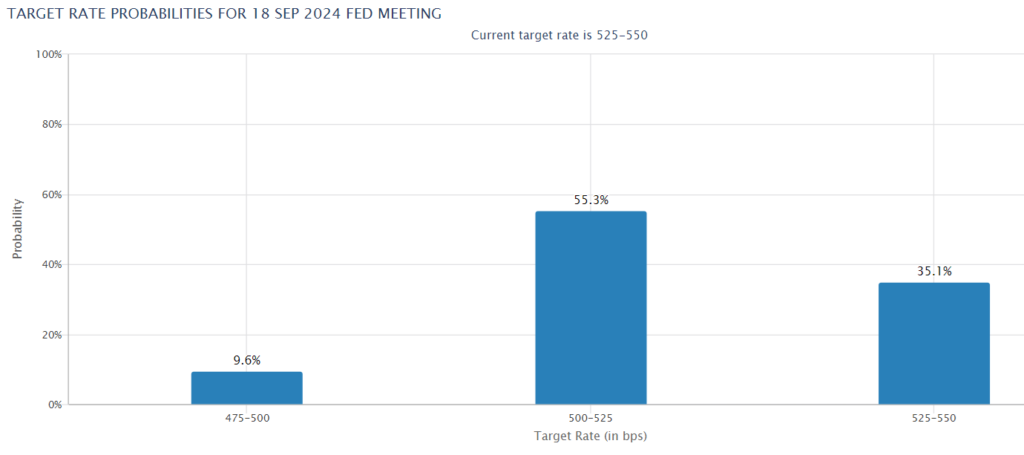

Following the recent weak data, the market has raised Fed rate cut expectations. The market is now pricing in a 65% probability of a rate cut in September, upwardly revised from below 50% last week.

BNB hits a record-high

Gains haven’t been confined to Bitcoin. The global digital assets market cap jumped by 3% to $2.63 trillion, and trading volumes were up 12% over the past 24 hours. Other top crypto coins, such as BNB and Solana, posted increases of 12% and 5%, respectively.

BNB, which is associated with the Binance ecosystem, rose to $716, passing its previous all-time high of $691, reached in 2021. BNB rallied over 100% this year amid an improving outlook as it puts legal and regulatory woes behind it. BNB has significantly underperformed its peers in the 2024 bull run, but its fortunes appear to be turning. BNB’s market cap is approaching $110 million, making it larger than several well-known US firms such as Dell and Starbucks.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.