- $9.6 billion of Bitcoin moved from Mt Gox

- Suspected to be part of the repayment plan to creditors

- Fears of resale ease

- US GDP and inflation data in focus

Bitcoin is holding steady after falling 1% yesterday but remains within a narrow trading range of $60k to $70k since March. Attention is turning to key U.S. economic data, which could keep traders on the sidelines. Other cryptocurrencies are also trading flat after, with Ether down -0.25%.

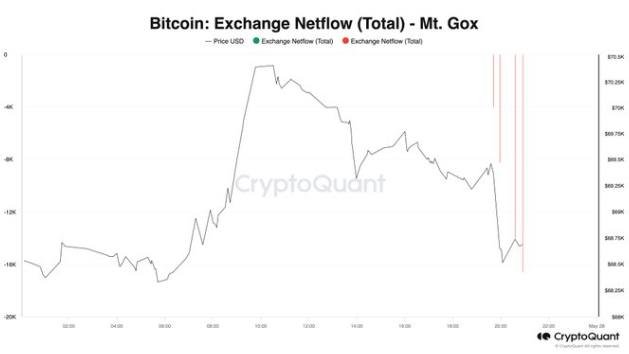

Bitcoin fell 3% at its worst yesterday, dropping to a low of $67,250 before recovering to $68k. Investors monitored transfers by wallets belonging to the failed Mount Gox exchange, where administrators have been ramping up efforts to return a $9 billion hold of Bitcoin to creditors.

$9.6 billion of Bitcoin moved as part of Mt Gox repayment plan

According to CryptoQuant and Arkham Intelligence data, over 137,000 Bitcoins worth over $9.3 billion held in Mount Gox wallets were moved. Mt Gox was once the largest Bitcoin exchange in the World before being hacked in 2011 and going bankrupt in 2014. Creditors have since awaited the repayment of their holdings.

The transfer from Mount Gox wallets to an unknown address in 13 transactions was the first movement of assets from the cold Mount Gox wallets in over five years and could be part of a plan to repay creditors by October 31st, 2024. The key question is whether those who receive the tokens will sell their tokens, this concern weighed on Bitcoin yesterday. However, these moves are not expected to have a long-lasting impact on Bitcoin’s price. Today, those worries appear to be easing amid expectations that creditors could hold the transferred Bitcoin rather than sell it to the open market, bringing some relief to Bitcoin.

US GDP & inflation data in focus

That said, that relief has been counted by ongoing concerns over the prospect of high interest rates for longer in the US.

A series of stronger-than-expected US data and a string of hawkish comments from Federal Reserve officials over the past two weeks signal that the bank needs more convincing that inflation is cooling towards the 2% target.

As a result, attention is squarely on U.S. economic data, with the first reading of US GDP due later today. Any signs of economic resilience could give the Fed more room to keep interest rates elevated.

Tomorrow, the more closely watched core PCE index, the Fed’s preferred gauge for measuring inflation, will be in focus. In recent weeks, the market has been pushing back rate cut expectations from September towards November. According to the CME Fed watch tool, the market is now pricing in just a 50% probability of a 25 basis point rate cut in September, with the first-rate cut being fully priced in for November.

High interest rates bode badly for cryptocurrencies, which often perform better in high liquidity environments.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.