- Bitcoin falls away from 65,500

- Long Bitcoin liquidations rose to $30 million

- 2-weeks post halving the Bitcoin price is flat

- Exchange inflows plunge to the lowest level in 10 years

After briefly rising above 65,500 at the start of the week, Bitcoin is heading lower toward 62,000. Long liquidations have increased to over $30 million in the past 24 hours amid choppy price action from the cryptocurrency.

The rise in volatility in the months following the halving event (a pre-programmed event that reduces the rate at which new Bitcoins are created and halves the reward to miners for validating transactions) isn’t unusual. Looking at historical data, in the two months following each of the previous halving events, Bitcoin has experienced drawdowns of between 5% and 15%, except one halving, before making a sustained move northward.

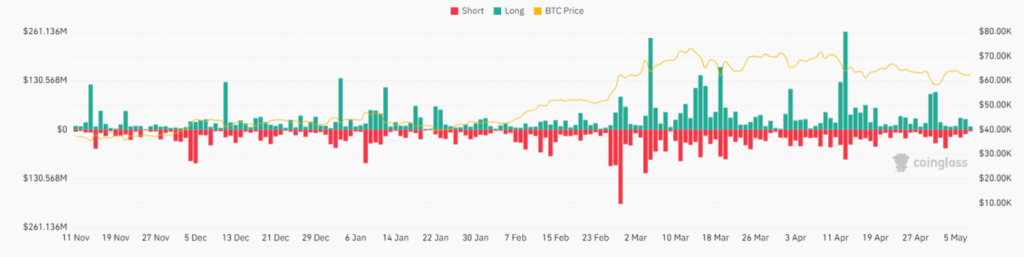

Liquidations

While Bitcoin experienced $40 million in liquidations over the past 24 hours, the broader cryptocurrency market experienced a total of $145 million in liquidations. Coinglass data confirms that, in line with Bitcoin data, most of these total liquidations were of long positions.

Bitcoin liquidations chart

These liquidations come as the price of Bitcoin has dropped almost 3% in the past 24 hours, while Ether has fallen 3% across the same period to $3000.

Post-halving price moves

According to a report by Glassnode, the two prior halving cycles saw prices flat two weeks after the halving; only the first halving event saw an 11% post-halving increase. Broadly speaking, the first 60 days post-halving see choppy, volatile trade with a slight bearish tilt. Bitcoin recently plunged to a low of 56,500 before recovering to its current price of around 62k, which is approximately where Bitcoin traded at halving.

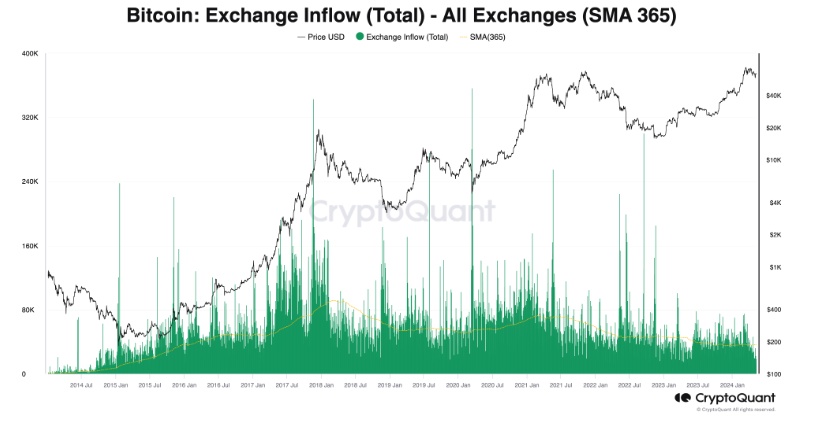

Exchange inflows plunge

Interestingly, Bitcoin’s moves come as exchange inflow levels are at the lowest level in a decade, suggesting that investors are in no mood to keep coins available for quick sales on the exchange.

Bitcoin: Exchange inflows plunge

According to CryptoQuant, April and May have seen some of the lowest daily exchange inflows for decades.

This data suggests that hodler sentiment is changing, and investors are looking to hold onto their crypto investment for a more extended period despite short-term price volatility. This was the case even as the Bitcoin price fell to the low of 56,500 last week as trades looked to wait out the short-term fluctuations. The hodl strategy is increasingly popular amid expectations that the Bitcoin price will increase over time following the halving event.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.